Corporate Information TOP > For Investors > Corporate Governance

We recognize that we need to strengthen corporate governance in order to achieve our management goals and improve our corporate value while building relationships of trust with all stakeholders surrounding the Kibun Group, including shareholders, customers and employees, and that this is an important management issue.

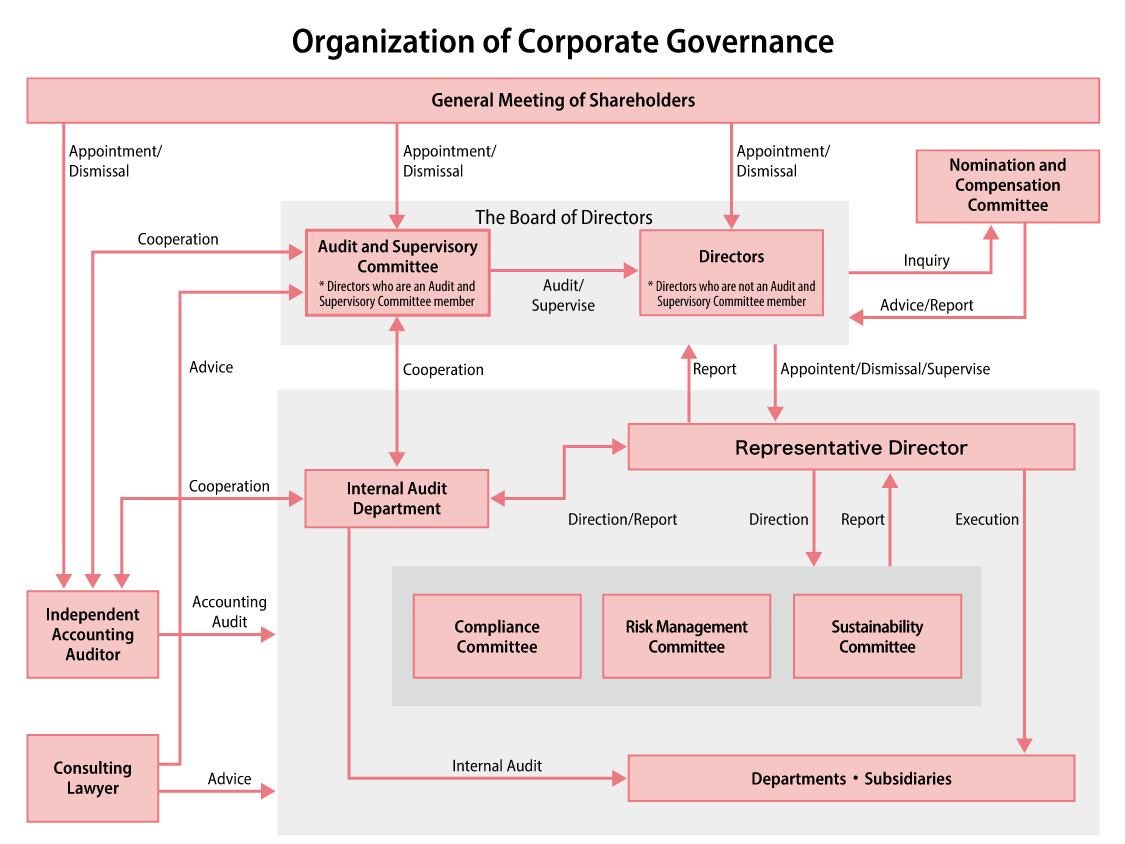

Therefore, in 2019, we transitioned to a company with an Audit and Supervisory Committee. Since Audit and Supervisory Committee members (including independent directors) have voting rights on the Board of Directors, the function of supervising the Board of Directors, which is the decision-making body for company management, has been strengthened. Audit and Supervisory Committee members also audit the legality and appropriateness of daily activities, including the execution of duties by directors, thereby strengthening the function of management oversight over directors.

We have also established a system to delegate some important business execution decisions (excluding matters not covered by the Companies Act) to the Representative Director, enabling flexible company management based on swift management decisions.

Furthermore, we have established a Nomination and Compensation Committee (voluntary committee) to enhance the objectivity and transparency of the procedures for nomination of directors and the compensation for directors. The Committee is chaired by an independent director, and the majority of members are independent directors. The Committee deliberates on matters concerning the nomination of directors and the compensation for directors, and the Board of Directors respects the content of committee's deliberation to the extent possible.

In addition, as a complement to the above corporate governance system, we have established committees to examine matters related to risk management, compliance, and sustainability.

The management decision-making, business execution, and supervision bodies of the Company are as follows.

The Board of Directors of the Company comprises 12 directors (including 4 outside directors). The Board of Directors meets once per month, in principle, in addition to holding ad-hoc meetings as necessary to ensure timely decision-making.

The Board of Directors determines matters prescribed in laws, regulations, and the Articles of Incorporation, as well as important matters related to management, while supervising the execution of business by each director.

The Audit and Supervisory Committee comprises 4 Audit and Supervisory Committee members (including 3 outside directors), and monitors governance and the state of operations, and audits the execution of duties by the directors.

The outside directors monitor management based on their professional experience and expertise.

The Company has also appointed 1 full-time Audit and Supervisory Committee member to facilitate the demonstration of the audit/supervision functions of the Audit and Supervisory Committee, by gathering information from directors (excluding directors who are Audit and Supervisory Committee members), gathering information through attendance at important meetings, and enabling full cooperation between the Internal Audit Department, which is an internal audit division, and the Audit and Supervisory Committee.

The Company has established a Nomination and Compensation Committee, a voluntary committee chaired by an independent outside director, the majority of the members of which are independent outside directors, as an advisory body to the Board Directors, to ensure the fairness, transparency, and objectivity of procedures related to the nomination and compensation of directors, executive officers, senior advisors, and advisors (hereinafter collectively referred to as “Directors, etc.”), and to further enhance corporate governance.

The Nomination and Compensation Committee deliberates and makes recommendations on matters related to the appointment and dismissal of candidates for Directors, etc., matters related to the compensation of Directors, etc., and other matters on which their opinion is requested by the Board of Directors, and the Board of Directors respects the opinions of the Committee to the greatest extent possible.

The Company has entered into an audit engagement agreement with Ernst & Young ShinNihon LLC, as the Independent Accounting Auditor, to undergo accounting audits.

There are no special interests between the Company and the said auditing firm or their engagement partners who engage in audits of the Company.

The Risk Management Committee, in accordance with our Risk Management Regulations, comprehensively monitors various management risks and formulates Risk Management Plans to address identified risks, with the approval of the Board of Directors, each term, and confirms the state of response to such risks.

The Compliance Committee comprises a chairperson who is appointed by the Board of Directors and members who are nominated by the chairperson. This Committee formulates compliance measures such as the establishment of a Code of Conduct and Action Guidelines, and confirms the state of compliance.

Currently, the Representative Director serves as the chairperson of the Compliance Committee.

The Sustainability Committee, which is chaired by the Representative Director, summons different managers from the business divisions depending on the themes to be discussed.

The Sustainability Committee conducts cross-sectional discussions and deliberations on the Group’s management policies and management plans from the standpoint of sustainability, while also reporting and making recommendations to the Board of Directors.

The Company has established an Internal Audit Department, which is independent of the other operational divisions, and which reports directly to the Representative Director.

To contribute to the streamlining of management and increased efficiency, and to strive for mutual communication and coordination among the businesses, the Internal Audit Department accurately grasps the assets and operations of the Company from the standpoint of monitoring the status of internal controls, and conducts internal audits on the overall operations of the Company and its affiliates, including audits of the appropriateness of accounting and operations.

In accordance with the provision of Article 427, paragraph (1) of the Companies Act, the Company has entered into an agreement with 4 non-executive directors to limit their liability for damages under Article 423, paragraph (1) of the same Act. Pursuant to such agreements, the defined maximum amount of liability for damages is the minimum liability amount provided for under Article 425, paragraph (1) of the same Act.

Such limitation of liability for damages shall apply only when the relevant non-executive directors have performed their duties, which is the cause of the liability, in good faith and without gross negligence.

The Company has entered into a directors and officers (D&O) liability insurance policy with an insurance company, as stipulated in Article 430-3, paragraph (1) of the Companies Act. The scope of the insured persons under the insurance policy are the directors (including directors who are Audit and Supervisory Committee members), Audit & Supervisory Board members, and executive officers, etc. of the Company and its subsidiaries, and all insurance premiums are borne by the Company.

The insurance policy covers damages including legal expenses and damages in the event that the insured person bears liability for damages originating from acts performed in connection with their work. However, so as not to impair the appropriateness of the duties of the insured persons, grounds for exemption have been established, including the exemption of damages originating from criminal acts, fraudulent acts, and acts performed in recognition of violation of laws or regulations by the insured persons.

The term of the D&O insurance policy is one year, from June 28, 2022. The Company plans to renew the policy prior to the expiration of that term by resolution of the Board of Directors.